The Best Guide To Bankruptcy Benefits

Wiki Article

The 5-Minute Rule for Bankruptcy Lawyers Near Me

Table of ContentsBankruptcy Court for BeginnersBankruptcy Information Fundamentals ExplainedBankruptcy Attorney Near Me - An OverviewRumored Buzz on Bankruptcy BillOur Bankruptcy Benefits DiariesExcitement About Bankruptcy Attorney Near Me

Chapter 13 is commonly better to chapter 7 since it enables the borrower to maintain an useful asset, such as a home and also allows the debtor to suggest a "plan" to settle creditors gradually generally 3-5 years. Chapter 13 is likewise utilized by consumer debtors that do not certify for chapter 7 relief under the means test.Chapter 13 is very different from chapter 7 considering that the phase 13 borrower usually stays in possession of the home of the estate and pays to financial institutions, through the trustee, based upon the debtor's expected revenue over the life of the strategy. Unlike phase 7, the debtor does not obtain an immediate discharge of debts, however.

This magazine reviews the applicability of Chapter 15 where a debtor or its building is subject to the legislations of the United States as well as one or more international countries.

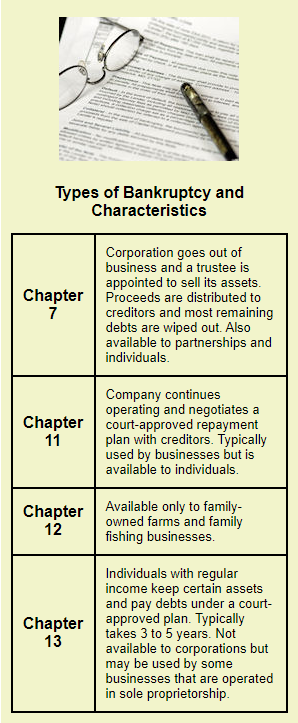

Bankruptcy Regulation in the USA is Federal Legislation under Title 11 of the United States Code. To put it simply, New Jersey Bankruptcy Regulation is mostly assisted by the United States Code. You have actually most likely come across Phase 7, or Chapter 11, or Phase 13. Those are actual chapters "in guide" of the Insolvency Code, and also each Chapter affords one-of-a-kind arrangements.

Little Known Facts About Bankruptcy Court.

A Phase 7 insolvency is suitable to both companies as well as individuals. In a company atmosphere, a Phase 7 bankruptcy is a liquidation. In the simplest terms, the properties of the company are sold to pay financial institutions pursuant to a priority system. In an individual Phase 7 bankruptcy, there is no liquidation of the person.

There is no minimum amount of financial obligation required in order to be eligible to file for Insolvency. All financial debt should be noted on a Personal bankruptcy petition.

If you took a financing to buy a vehicle as well as can not make your month-to-month settlements, your car can be repossessed by the loan provider. A common time structure to be concerned regarding foreclosure would be 45-75 days misbehavior. There are several

Bankruptcy Court Fundamentals Explained

Also if you have nondischargeable financial obligation, insolvency may still be an alternative.Your state provides the products insolvency filers can safeguard in its insolvency exemption legislations, although some states allow filers use the government personal bankruptcy exemptions if they 'd protect extra building. (You must pick one checklist or the otheryou can not use exemptions from both listings.) You'll check my site use the exact same exceptions in both Chapters 7 as well as 13.

, you 'd lose the nonexempt building, and the trustee designated to manage your case would sell it and provide the earnings to your financial institutions., you don't shed nonexempt property. Instead, you have to pay creditors what it's worth through the repayment plan.

You can maintain every little thing in Chapter 13, however it can be pricey. You need to pay your creditors the value of any type of residential or commercial property you 'd lose in Chapter 7. Generally, companies don't file for Chapter 7 or 13. bankruptcy attorney. Rather, take into consideration Phase 11 or Phase 11 subchapter V for local business.

A Biased View of Bankruptcy Business

Qualifying for Phase 13 isn't ever basic, as well as due to the countless difficult regulations, you'll wish to deal with an insolvency attorney. Until after that, you can learn more about the Chapter 13 repayment plan and obtain a concept about whether you make adequate income to cover what you'll need to pay.It's not excellent, however it will show you what you should pay (you may have to pay even more). Soon after you file your "petition" or insolvency documentation, calls, letters, wage garnishments, and also even collection lawsuits must come to a stop.

You'll pass on financial institution declarations, income stubs, income tax return, and also various other records for the insolvency trustee's review. All filers will participate in a "341 meeting of lenders." At the conference, the trustee will inspect your recognition and ask concerns regarding your declaring. Creditors can appear as well as ask inquiries as well, yet they rarely do.

Usually, after one year you will be discharged from insolvency as well as all of your financial debts will be written off. Insolvency handle both safeguarded and also unprotected debt. A protected financial obligation is a car loan on which home or products are readily available as safety and check out here security versus non-payment. Home mortgages and also vehicle loan are the most common secured car loans.

The Facts About Bankruptcy Revealed

In some situations, the High Court can make you bankrupt at the request of a creditor. A lender can seek for personal bankruptcy against you if you have actually devoted an act of insolvency within the previous 3 months.

As quickly as your personal bankruptcy starts, you are totally free of debt. Your financial institutions can no longer seek payment straight from you.

Any person can examine this register. Review a lot more in the ISI guide After you are made insolvent (pdf). The Official Assignee will certainly work out an Earnings Repayment Agreement their explanation or seek a Revenue Settlement Order for the excess of your income over the affordable living expenses for your circumstance, based on the ISI's guidelines.

The 6-Minute Rule for Bankruptcy Attorney Near Me

If you acquire possessions after the day when you are made insolvent (for instance, via inheritance) the Official Assignee can claim them and offer them for the benefit of your lenders. If you have a family members residence, by on your own or with an additional person, the Official Assignee may just market it with the previous approval of the court.If you hold building collectively (for instance, with your spouse) your insolvency will cause the joint ownership to be divided in between the Authorities Assignee as well as your non-bankrupt co-owner. If the Authorities Assignee has actually not offered your house within 3 years, possession might instantly move back to you, unless otherwise concurred.

Report this wiki page